As you achieve success with your niche, you’ll get unsolicited leads from your website. Prospects with no previous connection to your company will find your website through Google and schedule an appointment using your calendaring system. But once this happens, you’ll find that most web leads don’t meet the minimum requirements to become a client.

When you get only a few website leads per month, talking to a few unqualified prospects needing some quick advice doesn’t seem like much of an inconvenience. It may even feel like you are doing a good deed. But when you start getting dozens of web leads, you quickly learn the frustration of having your calendar filled with unqualified leads.

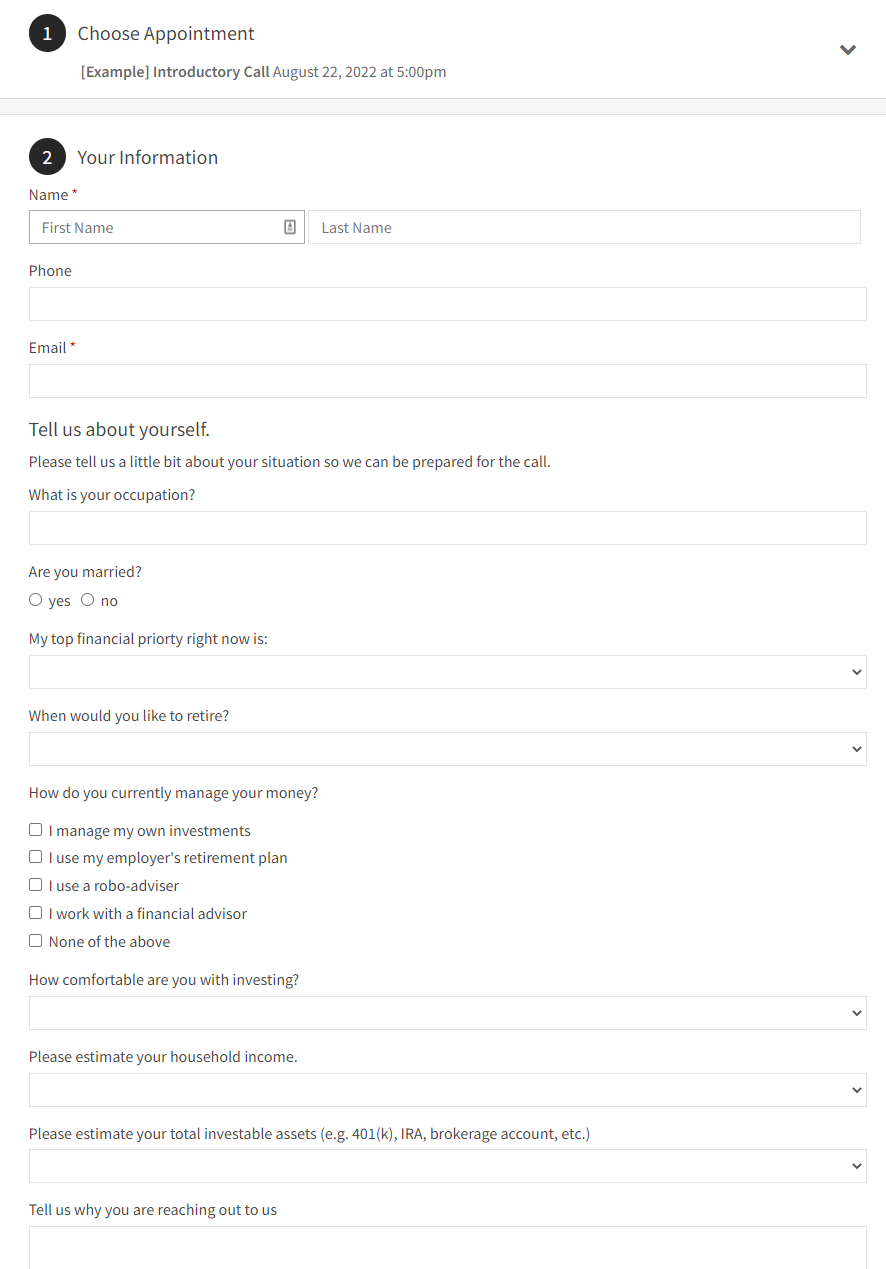

To solve this problem, use your calendaring software to ask basic qualifying questions. That way, before you even have a call, you can quickly identify the people who are clearly not a fit and refer them to an advisor who would be a better match. Many scheduling software systems allow you to add custom questions to gather this kind of qualifying information. Follow these guidelines when building your questionnaire.

Basic Information

When setting up qualifying questions, set the stage for why you are asking so many personal questions. We like to start by saying, “Tell us a little bit about your situation so we can be prepared for the call.”

Then ask some basic questions like:

What is your occupation?

What is your age?

What is your marital status?

When would you like to retire?

Financial Priorities

Next, ask about their top financial priority to begin to understand if they will be a good fit. Give the prospect some options to choose from, such as:

Planning for my retirement

Planning for the sale of my business

Saving for a major purchase or event

Investing my money

Rolling over investments from a previous employer

Investing an inheritance

Taking control of my finances after a life-changing event (e.g., divorce, death of a spouse, marriage)

You should customize these options to include the priorities that focus on the specific pain points of your niche. You should also have an “Other” option where they can fill in their own answer.

Investment Experience

Next, consider questions to understand their experience with investments and financial advice. It is helpful to know if they see themselves as a novice or an expert, a DIYer or a delegator. Questions you could include are:

How do you currently manage your money?

How comfortable are you with investing?

Financial Situation

Next, ask questions that reveal whether they meet your financial minimums. This is important information to know to refer out nonqualified prospects if it is obvious you can’t help them. Queries to financially qualify your leads include:

Estimate your household income.

Estimate your total investable assets.

Estimate your total net worth, including real estate and businesses.

Make these questions easy to answer by providing a range for each query instead of requiring the prospect to give exact amounts.

You will want to set up your ranges so you can immediately identify if the prospect is qualified. The first range should be someone who absolutely won’t qualify. Let’s say your stated minimum account size for investable assets is $500,000, but you are flexible if they are high-earning prospects. In this case, you may know that you won’t take anyone with less than $250,000. So “Less than $250,000” would be the first range—the unqualified range.

The next range is for people who are not currently qualified, but you may be flexible about working with them under the right circumstances. In this case, it is people with more than $250,000, but they still don’t meet your minimum of $500,000. You will need to look at their answers to your other questions to see if it makes sense to schedule the introductory call.

The next range is for someone who would be solidly qualified but maybe isn’t what you would consider ideal—for example, $500,000 to $1 million.

The next range is for someone who fits your ideal client’s financial profile. Let’s say $1 million to $5 million in investable assets.

And the final range is for someone who is beyond your ideal client profile. Some firms would love to have clients in this last range. Other firms may use that information to disqualify prospects because their financial situation may be too complex for the services the firm offers.

OPEN-ENDED

At the end of the questionnaire, you’ll want to ask, “Tell us why you are reaching out,” so the prospect can explain, in their own words, why they’re scheduling an appointment. Their response can really help you understand if they are a good initial match. It will also give insight into whether the prospect anticipates a windfall that would make them qualified in the near future even though their current answers don’t.

Marketing Source

Finally, you should ask how they heard about you to track your marketing efforts.

When you establish this process, you might make filling out the fields optional so that you don’t discourage people from contacting you. Our experience is that even if the fields are not required, most prospects will complete the form, especially if they are serious about hiring a financial advisor.

If you currently qualify your leads by phone, use the same questions on your call as you would on the website.